You’ve spent decades working, so you don’t want to spend your retirement years scrimping for cash.

How can you make sure that doesn’t happen?

There’s a whole host of factors that will determine your lifestyle in retirement – savings, tax, investment strategy and more.

It can be complex – but it doesn’t have to be. There are tools and strategies that can help you enjoy your retirement if you start preparing for it now.

Start with a clear goal

The starting point is having a clear idea of the type of retirement lifestyle you’re after. This may be hard to know if you’ve still got a while to go before retiring, but the sooner you start thinking about it, the sooner you can implement a plan to turn your retirement dreams into a reality.

Some of the things you might consider are:

-

How often you would like to travel and the types of holidays

-

Whether a sea change or tree change is part of your plan

-

Downsizing – or upsizing. What are your accommodation plans in the future?

-

The types and frequency of any recreational activities

-

Do you intend on providing financial assistance to your family?

-

What options would you like to have in relation to help and support either at home, or perhaps in a retirement village or aged care facility?

Once you’ve decided on your retirement lifestyle, you can work through the likely cost of your expenses, where your retirement income will come from, and finally – “how much do I need, to live the life I want in retirement?”

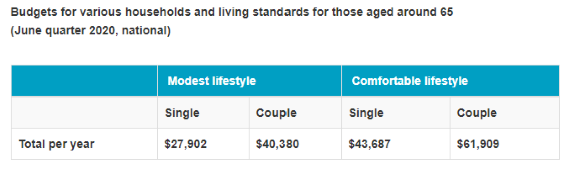

The Association of Superannuation Funds of Australia (ASFA) gives us a general guide. According to their research1, updated quarterly, this is what you need to live at two different levels in retirement:

The figures in each case assume that the retiree(s) own their own home and relate to expenditure by the household. This can be greater than household income after income tax where there is a drawdown on capital over the period of retirement.

A modest retirement lifestyle would be one that’s slightly better than you’d enjoy on the Age Pension.

A comfortable retirement lifestyle includes a better standard of living (including better consumer goods) and more recreational activities such as some overseas travel.

Calculating how much you’ll need to support this lifestyle

ASFA’s figures give us a good starting point, a sense of what the average retirement might look like and what it would cost.

But what’s more important, is how much capital you need to support the lifestyle you want – and how you can go about accumulating that capital.

A retirement calculator can help you answer all these questions because it covers a whole range of factors.

-

Your current and potential super savings. It takes into account how much you’ve currently saved and your future saving based on income and your ability to save extra money into super.

-

Your investment choices. Increasing the return on your super savings can make a big difference to the amount of capital you retire with and your retirement lifestyle when you get there.

-

Your family situation. A retirement calculator allows you to build your spouse’s income, contributions and final super balance into the calculation.

-

Social Security and part-time work are two crucial ways in which many people at least partially fund their retirement. The forecaster helps estimate the effect any Age Pension you are eligible for (and any work you do) has on your retirement income.

How to avoid running out

In short, using a retirement calculator gives you an in-depth view of how much you can save for retirement and what that turns into as a regular income.

Because it integrates so many factors, you can look at the changes that might make the most difference whether that’s your investment approach, contributions strategy, pension eligibility or contribution from your spouse.

From this knowledge comes the power to create a personalised super strategy. One that gets you to the retirement lifestyle you’ve dreamed of and helps to make sure you don’t run out of money.

Speak with a professional

Naturally, if you want expert help to balance the factors mentioned above, and guidance on the disciplines to save more or invest differently, talk to us on Phone (07) 3343 9228 we can also develop strategies to help you retire earlier, if that’s a goal you’re after.

1 ASFA Retirement Standard – June 2020 https://www.superannuation.asn.au/resources/retirement-standard

Source : MLC Insights September 2020

National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686. MLC Limited uses the MLC brand under licence. MLC Limited is a part of the Nippon Life Insurance Group and not part of the NAB Group of Companies. The information contained in this article is intended to be of a general nature only. Any advice contained in this article has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice on this website, NAB recommends that you consider whether it is appropriate for your circumstances.

Important: Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.